The Financial Road Map® Process Can Help You Acquire More Ideal Clients, Elevate Existing Clients to Ideal Clients, and Become Enormously Financially Successful

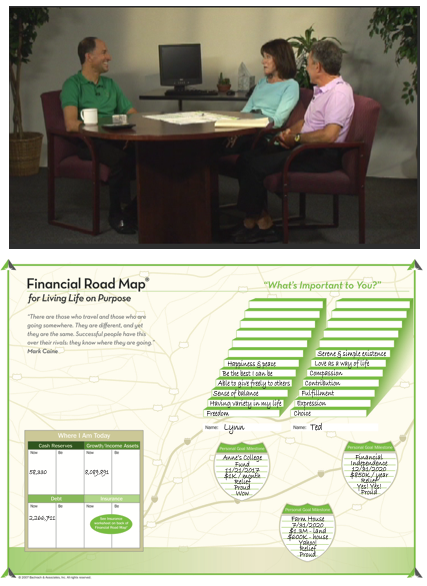

(The video below gives you a short, guided tour of the Financial Road Map process.)

Discover the most valuable client acquisition process from one of the most important books ever written for the financial services industry.

Many of the most successful advisors in our industry have used the Financial Road Map® from Values-Based Financial Planning to:

- Acquire More Ideal Clients

- Elevate existing clients to Ideal Clients

- And become enormously financially successful

All while dramatically increasing the value for the clients and the client experience.

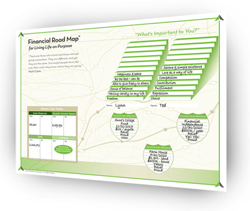

The Financial Road Map® was designed to help your clients make better informed financial decisions based on their personal goals & milestones.

It does this by making the financial planning process:

- Visual

- Experiential

- Compelling

- Interactive

With the Financial Road Map® they need less information to see the wisdom in your advice and take action on your recommendations.

Results Received Using The Financial Road Map® Process…

- 5 Financial Road Map® Interviews

- £31,825 in recurring revenue as a result of AUM

- £62,083 in commissions generated from other advice implemented

- 12 referrals

– David A.

- 2 Financial Road Map® Interviews

- $11,400 in recurring revenue as a result of AUM

- $26,901 in commissions generated from other advice implemented

- 2 referrals

– Jonathan M.

- 1 Financial Road Map® Interview

- $30,000+ in first year planning fees, FUM %, and commissions generated from other advice implemented.– Rob J.

- 12 Financial Road Map® Interviews

- $20,900 recurring revenue as a result of FUM

- $27,600 in commissions generated from other advice implemented

- 3 referrals– Kathy P.

The Key To Building Trust…

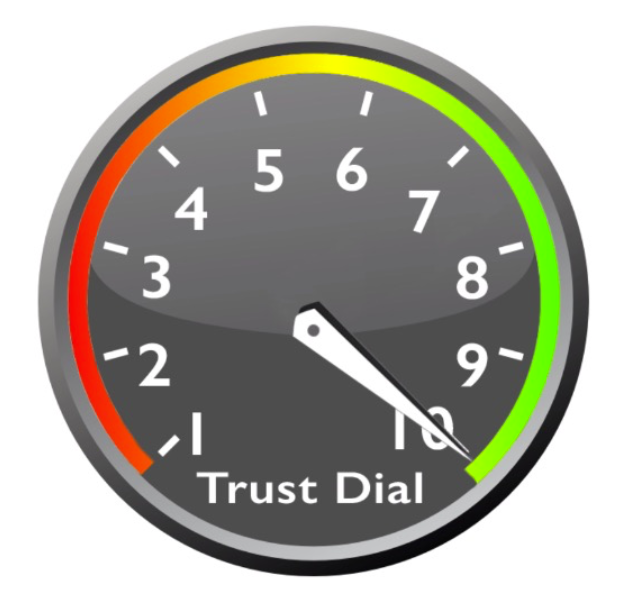

Every prospective client has embedded in their subconscious mind an imaginary “Trust Dial“.

Everything you say and do moves the “Trust Dial” one way or the other.

The Financial Road Map® is the ultimate “relationship-shifter”.

It will help you shift your client relationships to the level of trust necessary for them to:

- Consolidate All Of Their Assets With You

- Take Action On All Of Your Other Advice

- Happily Introduce You Others Who Will Become Your Next Ideal Clients

Just moving from an “8” to a “9” on the Trust Dial could be the difference between your client placing all of their assets with you or going with someone else.

The Financial Road Map® has helped done for thousands of successful financial advisors and it can help you do the same.

Key Benefits

- The Financial Road Map® puts everything a client needs to make good choices about their financial planning on a single piece of paper

- In subsequent meetings the Financial Road Map® then becomes the compass for acting on the advice they receive

- In turbulent times the Financial Road Map® is the port in the storm that keeps them on plan

In other words, the Financial Road Map® will:

- Help you get hired in the first place

- Inspire clients to implement your advice

- Keep clients on track regardless of what happens in the economy

Why Clients Love the Financial Road Map®:

- Visually Compelling

- Big & Colorful

- Simple

- Puts what’s important in perspective on one piece of paper

- It is extremely valuable whether they hire you or not

Why You Will Love the Financial Road Map®:

- It’s a proven process for getting hired by your Ideal Clients

- It lets you get paid for real financial planning

- Helps make sure you keep getting paid ongoing with less clients and less headaches

Following the Financial Road Map® Leads to Predictable Results:

- Collecting More Planning Fees

- Attracting More Assets Under Management

- Implementation of other advice: insurance, annuities, estate planning, etc.

- More Referrals, More Often

These are skills you don’t learn from your financial planning software.

The Financial Road Map® Is An Integral Part Of The

NEW AdvisorRoadmap Training Platform

Bill Bachrach’s AdvisorRoadmap™ Virtual Training for Financial Advisors is a web-based, virtual training platform unlike anything in the industry.

You will experience a self-guided, online virtual training platform packed with interactive training courses, videos, scripts, demonstrations, and high-value resources to help you master the communication skills and repeatable processes that are crucial to acquiring and serving Ideal Clients.

You will also be walked through exactly how to best deliver The Financial Road Map®

to prospects and clients, step-by-step in complete detail.

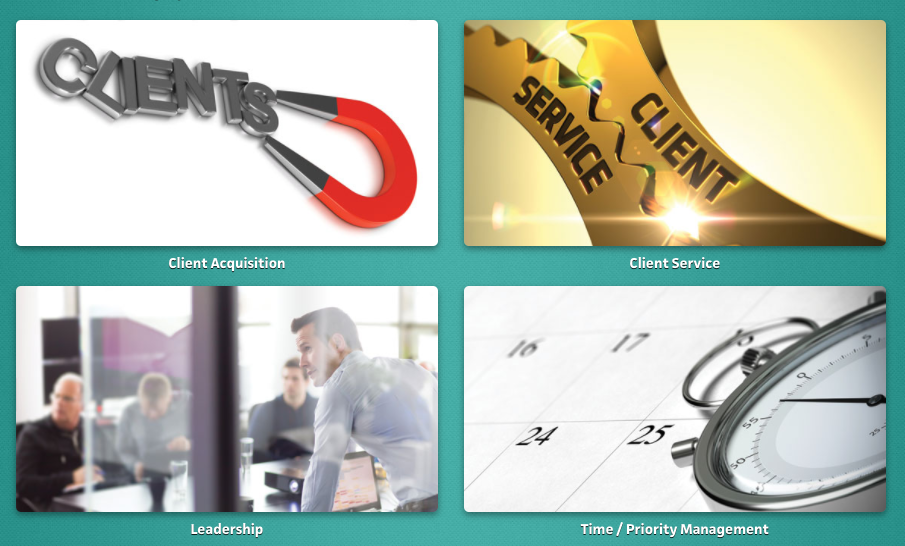

As an AdvisorRoadmap Member,

You Will Master These 4 Areas Of Your Business:

Who is the AdvisorRoadmap Training Platform Designed For?

Financial advisors, successful veterans and even rookies…

Any advisor who is dedicated to…

– Doing financial planning,

– Doing better financial planning.

– Getting paid more for financial planning,

– Getting paid in advance for financial planning,

– Getting clients to implement 100% of the advice from financial planning, and

– Being DOL Compliant.

The $10k Financial Road Map® Action Plan

GOAL: To schedule 30 Financial Road Map® interviews and help you see a minimum $10k return on your investment.

Day 0 – Getting Started Immediately

– Set up username and password

– Watch orientation video

– Become familiar with the tools and resources

– Register for the next calls

Week 1 – Learning and Scheduling appointments for the future (laying the foundation)

– Engage in the practice chapters

– Make calls (using our scripts) to schedule Financial Road Map® interviews for week 3 and 4

Week 2 – Continuing the training

– Continue learning

– Schedule interviews

– Tracking your results

Week 3 and 4

– Conduct initial FRM interviews

– Start generating revenues from planning fees, gathering more assets, revenue from other advice implemented, and referrals

– Actually complete 15 Financial Road Map® interviews

– Continue to schedule more interviews

End of Week 4

– Return of your investment… You should have a minimum of a $10k return on your investment.

– How? Planning fees from existing clients, higher fees, bringing more assets over, buying insurance, etc.

– Maybe not all in the bank yet but it’s in process

– Certainly past the first year’s investment in the training

Rinse and Repeat!

– By the end of 90 days you should have an additional $30k-$50k. That’s our expectation.

Does Following The Financial Road Map® Process Work?

Here Are Some Advisor Clients Sharing Their Experiences…

- 18 Financial Road Map® Interviews

- $75,013 Recurring revenue as a result of AUM

- $63,304 in commissions generated from other advice implemented

– Jim M.

-

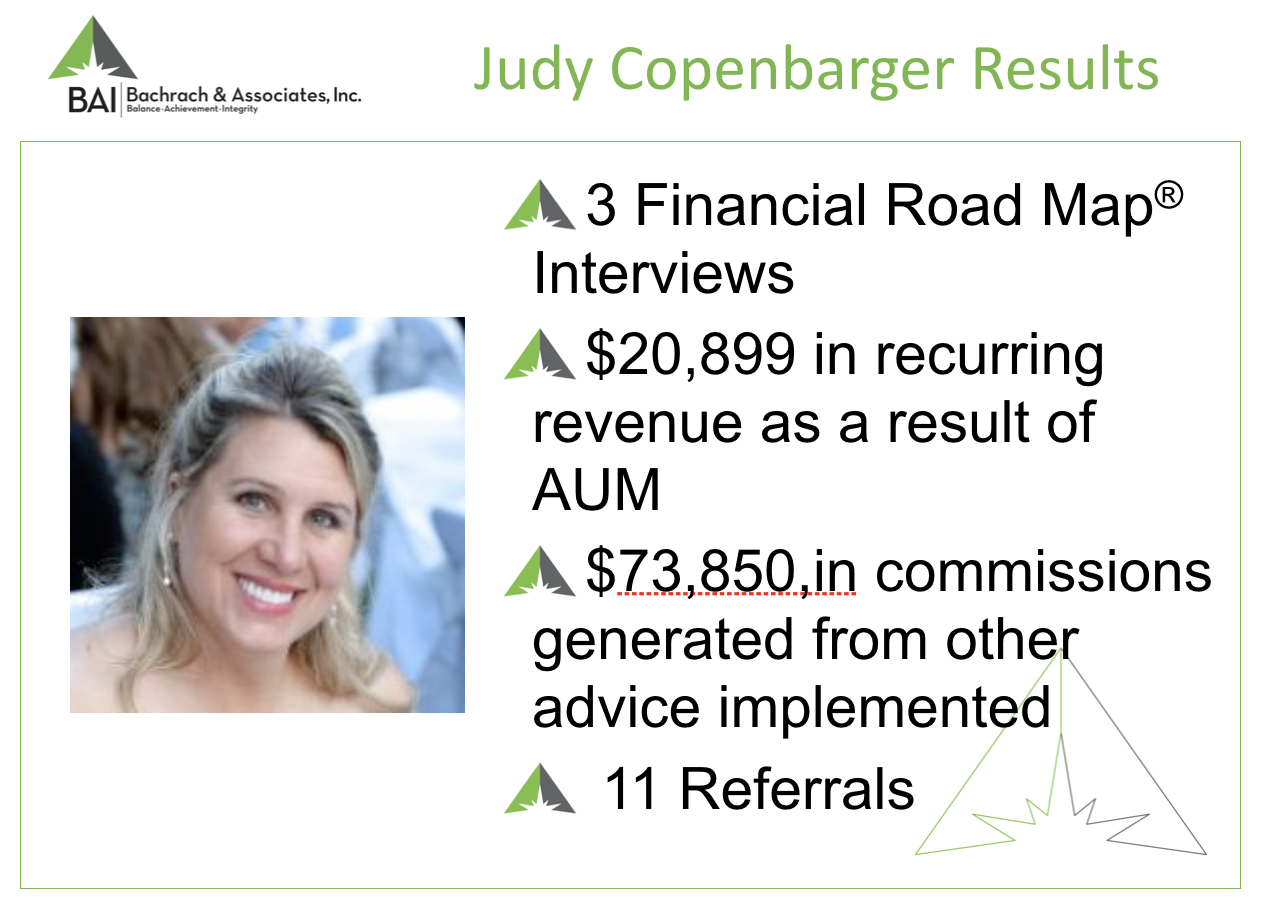

- 3 Financial Road Map® Interviews

- $20,899 in recurring revenue as a result of AUM

- $73,850 in commissions generated from other advice implemented

- 11 Referrals so far

– Judy C.

- 22 Financial Road Map® Interviews

- $163,541 in recurring revenue as a result of AUM

- $126,692 in commissions generated from other advice implemented

– Paul R.

- 15 Financial Road Map® Interviews

- $24,500 in planning fees

- $16,500 in recurring revenue as a result of AUM

– Rich J.

- 63 Financial Road Map® Interviews

- $67,200 in planning fees

- $78,000 in recurring revenue as a result of AUM

- $83,562 in commissions generated from other advice implemented

- 12 referrals

– David J.

“I thought I would spend my whole career working with people who have $500,000.

The Financial Road Map® gave me a process, the skill, and the confidence to acquire clients with millions.”

– Debbie Pursey

- “I have been using the Financial Road Map® for many years.

- As a person who is obsessed with keeping track of what works, I can tell you that I get hired 98.7% of the time that I conduct a Financial Road Map®.

- 77% of the time at the first meeting.”– Chris P.

- “The Financial Road Map® was instrumental to me going from $388,000 of commission revenue a year to $1.6M of recurring revenue per year in 34 months.”

– Mark Little

As an AdvisorRoadmap Member, You’ll Also Receive:

-

- Interactive Weekly lessons

- Monthly webinars with Bill Bachrach

- Scripts for exactly what to say

- High-Value Article Vault

- High-Content Video Vault

- Keynote speech videos

- Advisor FAQ database

- Daily motivation and accountability

- Community of like-minded financial advisors

- Advisor Forums

- Preferred pricing on live workshops

- Preferred pricing on accountability coaching

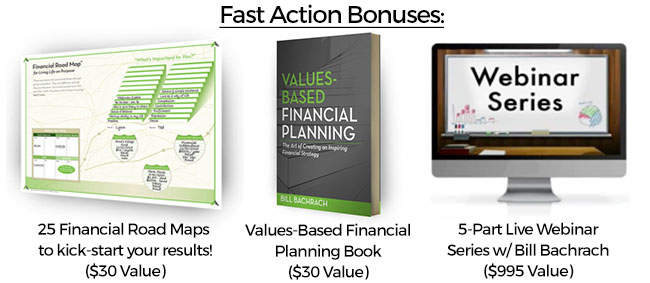

Limited Time Bonuses for Joining the AdvisorRoadmap™ Virtual Training Platform:

Fast Action Bonus #1: 25 Financial Road Maps shipped to your door to kick-start your results ($30 value)

Fast Action Bonus #2: Autographed copy of Values-Based Financial Planning ($30 value)

Fast Action Bonus #3: Complimentary tuition to a new 5-part webinar series: The Mindset and Strategies of Top Advisors.

The 5 webinars will cover:

- The Top Advisor Formula for Building an Ideal Business and Creating an Ideal Life.

- Why Top Advisors are Moving Away from an AUM Percentage to a Single Flat Fee

- The Top Advisor Client Value Promise

- The Self-Discipline, Productivity & Accountability Secrets of Top Advisors

- How Top Advisors manage their energy and move past limiting beliefs and fears to maximize their true potential

This webinar series will sell for $995 in May but you’ll get complimentary tuition by enrolling before April 30th at midnight PST.

Bonuses Expire in…

What AdvisorRoadmap™ Virtual Training Platform Members Have to Say…

After working with Bachrach & Associates, Inc. my annual recurring revenue per client is 40k, my business revenue is 650k and I take at least 4 weeks of vacation per year.

Since working with Bachrach & Associates I’ve acquired 7 Ideal Clients who pay my minimum predictable annual fee of $24,000 and generated an additional $152,000 in recurring revenue from AUM.

The scripts are brilliant. So many times you’re talking to somebody or put in a situation where you’re just winging it. That’s not ideal for them and it’s not ideal for you.

AdvisorRoadmap

Annual Membership (paid monthly)- Interactive Weekly lessons

- Monthly webinars with Bill

- Scripts for exactly what to say

- High-Value Article Vault

- High-Content Video Vault

- Keynote speech videos

- Advisor 24/7 FAQ database

- Motivation & accountability

- Monthly podcast w/ experts

- Discounts on live workshops

AdvisorRoadmap

Annual Membership (Save $300!)- Interactive Weekly lessons

- Monthly webinars with Bill

- Scripts for exactly what to say

- High-Value Article Vault

- High-Content Video Vault

- Keynote speech videos

- Advisor 24/7 FAQ database

- Motivation & accountability

- Monthly podcast w/ experts

- Discounts on live workshops